(£1,997 + £175 Insurance)

Read FAQ to understand why insurance payment is separate.

"I am now fully compliant and able to trade freely within the property field... "

When I first started out in 2012, I was excited to get my property business moving—but the compliance side nearly broke me.

I didn’t want to become a legal expert. I just wanted to sell deals and run my business. But I had no choice. Compliance was a legal requirement, and because I was just starting out, I had to do everything myself.

I spent months buried in legal jargon, calling solicitors, mortgage brokers, and reading outdated forums. Nothing was clear. Nothing was fast. And worst of all—even after I followed what I thought were the right steps... I still got it wrong.

In 2015, the inevitable happened. My business got audited.

And we failed.

I didn’t have the right policies or procedures in place. My KYC documents weren’t up to standard. The result? A fine of over £5,000.

That stung.

So I did what any determined business owner would do—I tried to fix it. I worked with HMRC, revised my documents, rebuilt my compliance system from scratch... and still, in the second audit, I wasn’t fully there. No fines that time, but still gaps, still red flags, still stress.

They wanted to check my documents again.

So I spent another month rewriting everything. On the third audit—we passed. Finally.

But it had taken me over four months of my life to get it right. Four months I’ll never get back.

And you know what? In 2024, HMRC issued £1.6 million in fines to estate agents and sourcers. It doesn’t surprise me. Because this system is not built for small businesses like ours.

It’s slow. Fragmented. Full of outdated advice.

At the same time, I kept hearing the same things from other sourcers:

“I want to get compliant, but I don’t have time. I don’t understand it. I don’t even know where to start.”

That’s when I knew: this has to be easier.

So I literally built the solution I wish I had.

A done-for-you compliance system that’s fast, legal, and simple. Just like using a conveyancer when buying a house—you let the experts handle the legal side so you can focus on the move.

I tested it on our own sourcing business. What once took four months now takes just 5 days. My system has now helped 100s of sourcers get compliant so they can now sell deals with confidence.

Since 2012, I’ve worked directly with HMRC to get compliance right for the estate agency industry—and since 2024, specifically for deal sourcing. My business has been audited three times. Every time, our policies have only gotten stronger.

This is exactly why I created Become Compliant™. It's designed to remove that worry you have in the back of your head of not being compliant, and not being able to legally sell deals, to be able to confidentially and proudly say you are a fully compliant deal sourcer, and to be able to co-source or sell deals to your investors.

Most compliance options fall into one of three traps:

❌ Info-only: PDFs or coaching programs that leave you to figure it all out

❌ Misleading platforms: Services that aren’t legally backed or skip key steps

❌ DIY: Endless forms, insurer confusion, and high risk of errors

Our solution is different.

We don’t give you more information so you have to still go and do it yourself — we give you results. Our unique One Form Intake System™ removes the complexity, cuts out months of wasted time, and gets you fully compliant faster than any other method available.

Unlike other services, we use the exact HMRC-approved process that we’ve tested and passed ourselves. Our team actually understands the deal sourcing industry because we come from it.

This isn’t about teaching you to do it yourself. It’s about removing the stress, doing it right, and getting you legally ready to sell deals in just 5 days.

Here’s why our clients choose us:

We’ve passed HMRC audits using this exact system. By the way, these audits are insanely intense.

We don’t just tell you what to do — we do it for you.

We’re the only service designed by sourcers, for sourcers, who have been in the property sales and sourcing industry since 2012!

The only system to give you paperwork and certificates in your business name so you can trade, legally as a deal sourcer under your own company. This gives you massive credibility as an independent deal sourcer.

Dedicated support during your compliance setup. We make sure it is right the first time.

You don’t need to become a compliance expert. You just need the right system — and a team that’s already been through it for you.

This is your shortcut to becoming a fully compliant deal sourcer, without the months of confusion and paperwork.

"The process was smooth and I was able to get going very quickly... "

Becoming compliant as a property deal sourcer can feel overwhelming—especially with the mountain of red tape and uncertainty around what’s legally required. That’s exactly why we created our streamlined, done-for-you system.

We call it “The Compliance Engine”—a simple 3-step process that handles everything for you.

You’ll start by completing a single, easy-to-follow form. No jargon, no confusion. This helps us understand your business setup and gather everything we need to get started.

Benefit: You hand off the admin stress to us—so you can focus on finding deals, not paperwork.

Our system automatically registers you with all required bodies and creates the key compliance documents tailored to your business.

Benefit: You get peace of mind knowing every legal box is ticked, backed by a system which is tightly integrated with the right authorities.

Access your full compliance pack in your portal with all the documents you need—professionally prepared and ready to go. You’ll also receive your official compliance certificate, so you can prove your legitimacy to partners, clients, and investors.

Benefit: In one smooth process, you’ll go from uncertain and exposed to fully compliant and confident.

And that’s it—just three simple steps to becoming legally protected and business-ready.

With becomecompliant.co.uk, you’ll never have to second-guess your compliance again.

Once you are compliant you are able to sell through our partners, such as Sitefindr®

This is by far the quickest way for you to sell your deals. Once you are fully compliant, you are able to join other clubs and sell your deals to their huge investor networks. You will be provided a discount on application.

Sell your deal with Sitefindr® and earn a minimum of £2,500

Extra bonuses given and updated yearly, to get you up and running quickly and correctly. These include

"... peace of mind knowing that they were handling everything professionally and updates along the way"

By law, you are not allowed to source or sell deals without being compliant.

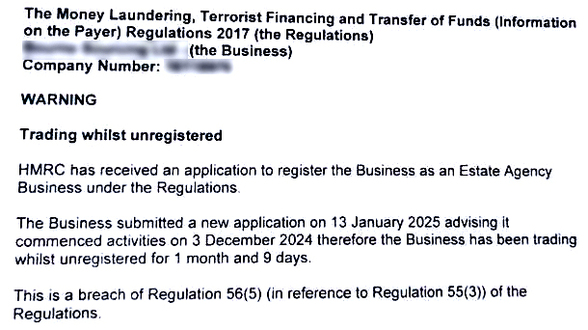

When you eventually do become compliant, the HMRC will track your income back and ask you why you haven't been registered, and potentially fine you accordingly from the day you started.

And they don't care how long that is, be in 1 month or 1 year.

An email sent directly by HMRC to a deal sourcer who wasn't registered correctly.

If you are not fully compliant within 30 days, you will get a full refund.

As long as you meet the two terms below, if we can't get you fully compliant within 30 days, we will give you a full refund, no questions asked.

You must complete the form and training within 48 hours of receiving the 'welcome email'.

You must provide all of the required business information we need to complete your application successfully.

"... amazing experience throughout! Thoroughly recommended"

A deal sourcer is a professional who specialises in finding and securing property investment opportunities on behalf of investors. They research the market, identify high-potential deals, and negotiate favourable terms, often leveraging industry contacts and knowledge.

Deal sourcers help investors save time and effort by filtering out unsuitable properties and providing deals that meet specific criteria, such as rental yield, capital appreciation, or development potential.

A Deal Sourcer is the same an Estate Agent in many ways, however, Deal Sourcers tend to specialise in the investment side of the industry.

Yes, a Deal Sourcer must be compliant with specific regulations, especially in the UK. Since sourcing property deals is considered a form of estate agency work, deal sourcers are required to comply with key regulations as described below.

Without these compliances, sourcers cannot legally operate, and it could put both them and their clients at risk

Deal Sourcers fall under the same banner as Estate Agent, and must adhere to the Estate Agents Act 1979

When you are audited (which could be 1 - 2 or more years from when you first start, you will be asked to show ALL compliance documents and registrations from the day you first started trading (not necessarily earning money in your account). Fines will be backdated to the date you first started.

This entire system is designed for beginners. You shouldn't have started your sourcing business without becoming compliant. If you have started, and traded already, you need to register ASAP, but be prepared for potential fines by HMRC. The longer you wait, the bigger the fine.

You do not need any tech ability. You will register into a platform, fill out 1 form and follow some links. There isn't much more to it!

You will need 10 minutes to fill out the Intake Form, and about 1 hour to do the video training.

You will have direct access to a support team to help you with any questions you have, although it is very self explanitory.

Unlike other programs, we provide an end-result for you in your business name, based on our history and being compliant since 2012. You get access to our policies built up and refined over the years. We are the only company in the UK that can offer this service.

You will be registered under your own business name and company name. You will have no association with Become Compliant. After discussions directly with the AMLS team with HMRC, this is the ONLY way to become compliant. You will have all insurances, certificates, and registrations in your own name. Be vary wary of companies putting your name under their company. If that is the case, you will not be covered.

We have a 100% success rate, however for whatever reason, if we cannot get you compliant, we will refund you the fee you have paid in full.

Legal compliance for deal sourcers is all about protecting clients and keeping the property market fair. It’s not just about ticking boxes—it actually helps sourcers do their jobs better and more professionally. Here’s why it matters:

Client Protection: Sourcers need to be part of a Property Redress Scheme (PRS), like The Property Ombudsman (TPO) or the Property Redress Scheme. This makes sure clients have a way to resolve any disputes if things don’t go as planned, holding sourcers accountable.

Keeping Things Legal: Deal sourcers must register with HMRC for Anti-Money Laundering (AML) supervision. They’re required to do their homework by verifying clients’ identities and making sure there’s no funny business, like illegal funds sneaking through property transactions.

Data Privacy: If a sourcer collects or handles personal data, they have to be registered with the Information Commissioner’s Office (ICO) and follow data protection laws (GDPR). This ensures clients’ info is safe and handled properly.

Professionalism and Transparency: It’s good practice for sourcers to have Professional Indemnity Insurance to protect themselves from potential claims. On top of that, they have to be clear and honest about their services and property details to follow Consumer Protection from Unfair Trading Regulations (CPRs).

Continual Professional Development: Deal Sourcers must continue to keep up to date with the current rules and regulations, and prove that they have done so, yearly.

By following these rules, sourcers can legally and ethically find property deals, protect their clients, and avoid any legal trouble. Plus, it makes them more trustworthy and professional, which is a big win for everyone!

You can use our 20 minute form or if you want to do it yourself this is what you need (and to keep up to date):

P.I Insurance

Professional Indemnity (P.I) Insurance is essential for deal sourcers to protect themselves against claims made by clients for professional negligence, mistakes, or breaches of duty.

This insurance gives peace of mind to both the sourcer and the client by covering legal costs and compensation if something goes wrong.

Anti-Money Laundering Supervision:

Anti-Money Laundering (AML) regulations require deal sourcers to register with HMRC to monitor and prevent the use of illicit funds in property transactions.

Sourcers must conduct thorough identity checks, verify the source of funds, and ensure that they’re not facilitating money laundering activities.

Your business must be registered on the AMLS register. If it is not, you are not compliant.

Non-compliance can result in severe penalties.

Anti-Money Laundering Training

AML training is mandatory for deal sourcers to understand their responsibilities under UK regulations.

This training ensures that sourcers can spot red flags, conduct customer due diligence, and report suspicious activity. Proper training keeps sourcers compliant and ensures they’re up-to-date with legal requirements.

AML, CDD, Risk Assessment & GDPR Policies and Procedures Paperwork

Deal sourcers must have documented policies and procedures covering Anti-Money Laundering (AML), Customer Due Diligence (CDD), risk assessments, and GDPR compliance.

These documents outline how the sourcer ensures legal compliance, protects client information, and manages risks. Proper paperwork shows that the sourcer follows industry standards and is fully prepared for audits or inspections.

These documents should be constantly updated.

Consumer Redress Scheme

Deal sourcers in the UK must be registered with an authorised Consumer Redress Scheme (like The Property Ombudsman or the Property Redress Scheme). This gives clients an official channel to resolve disputes if they are dissatisfied with the service provided. Being part of this scheme shows accountability and offers protection for both the sourcer and the client.

ICO Registration

Deal sourcers who collect and manage personal data must be registered with the Information Commissioner's Office (ICO). This ensures compliance with the General Data Protection Regulation (GDPR), safeguarding client data and ensuring it is handled lawfully and securely. Non-compliance can result in heavy fines for data breaches or improper handling of information.

Client Account & Insurance

If you are taking deposits / refundable fees, deal sourcers must maintain a client account, which is a separate, safeguarded bank account used to manage client funds, such as deposits or sourcing fees.

Additionally, insurance that ensures client funds are protected in case the sourcer's business faces financial difficulties.

Client Accounts are available through High Street banks, and you normally need a business account running with them first. Current wait times are up to 3 months with some banks due to approval checks.

As an investor, you typically don’t need to worry about the same level of compliance as deal sourcers, but there are still a few things you should keep in mind:

Anti-Money Laundering (AML) Checks: Even though you're not required to register for AML supervision like a sourcer, you’ll still likely need to go through AML checks when buying a property. This is to verify your identity and ensure that your funds are legitimate. It’s something that the sourcer or the legal team involved in the transaction will handle.

Due Diligence: While not a legal requirement, it's good practice for you to do your own research and due diligence on the deals you're investing in. This ensures you're making informed decisions and not getting involved in any risky or non-compliant transactions.

Data Protection: You don’t need to register with the ICO, but you should be mindful of how you handle sensitive information if you’re working closely with sourcers or other parties.

So, while you're not bound by the same regulations as a deal sourcer, it's still important to be aware of these checks and make sure everything is done above board to protect yourself and your investment.

The best Investors are 'Property Deal Makers' and make money from the deals that they don't want for themselves. In this case, you must become compliant.

If you sell a property deal without being compliant, you could face serious legal and financial consequences. Here’s what can happen:

Fines and Penalties: If you're not registered with a Property Redress Scheme (PRS), or if you haven’t followed Anti-Money Laundering (AML) regulations, you could face significant fines from authorities like HMRC or the National Trading Standards. These penalties can be quite hefty and are meant to enforce compliance.

Legal Action: Selling property deals without being compliant is illegal and could result in legal action. You may face lawsuits from clients, especially if the deal goes wrong or if they feel misled. Being unregistered or non-compliant also removes your ability to resolve disputes through official channels, leaving you more vulnerable to legal claims.

Damage to Reputation: Non-compliance can severely damage your reputation in the property market. Investors and clients prefer to work with professionals who follow the rules, and being caught operating illegally can make it hard to regain trust and credibility in the future.

Business Closure: Persistent non-compliance can lead to authorities shutting down your business activities. If you continue to operate without meeting legal requirements, enforcement bodies may take steps to restrict or close your operations entirely.

In short, selling property deals without being compliant is risky and can lead to legal trouble, fines, and damage to your reputation. It's essential to ensure you're following the proper regulations to avoid these problems.

All policies must have your business name attached to the documents to be fully compliant.

Insurance & ICO, PRS and access to your AML training is provided to you within 2 days.

You will have to complete your training while you wait for your business to be named under HMRC AMLS, which can take up to 45 days (although in most cases it is quicker).

We are currently running applications at a 5 day turnaround. You will be able to legally trade within 5 days of completing your form & training.

That's just enough time for you to get your website, cards, training and other bits out the way.

No, you do not need a client account to be a deal sourcer if you are not handling any money (apart from your non-refundable fees). Most deal sourcers do handle client money (holding fees). Holding these fees in a normal 'business bank account' is against law and regulation, so we suggest that you use your solicitor to hold your fees until you are due to be paid.

There are over 15 acts and regulations that deal sourcers must be aware of and adhear to. We will give you a document the required information on these policies. You are not required to know these from memory, but to be aware of them.

Yes, you can still use our service if you have started your compliance. You will be asked for details on this in your Intake Form when you sign up.

All policies are bought on your behalf for 1 year, so we get charged accordingly. In reality, if you are deal sourcing, you don't want your policies to expire at any point. If you stop trading, you can always cancel your subscription.

You can let us know you wish to cancel at cancellations@becomecompliant.co.uk.

We will remind you by email 30 days before your renewal is due.

To be independently compliant (you will need to have your own insurance policy with your name). For this to happen, you will need to pay the insurers directly. Don't worry, we have done all the hard work and negotiation for you already, you won't have any other forms to fill out, and you won't have to speak with anyone. it is just a separate link to pay for the insurance.

This is a compliance-done-for-you service. You will get everything you need to legally trade as a deal sourcer. Please see the section below for a breakdown of everything you will get.

And here’s the truth: HMRC and the legal bodies don’t wait until you’re “ready.”

If you start sourcing without full compliance, you’re risking serious fines, bans—and your entire business.

Most sourcers don’t realise this until it’s too late.

But now you do.

And now you’ve got an option that’s fast, legal, and done-for-you.

We are HMRC - audit approved. Integrated with every required compliance body. And we handle everything after you fill in one simple form.

So the only question left is—can you afford not to do this?

✅ Protect your business from day one

✅ Avoid costly mistakes and legal risks

✅ Get compliant in minutes, not months

Body | DIY PRICE | Become Compliant™ |

|---|---|---|

PRS | £186.00 | Included |

HMRC AMLS * | £740.00 + | Included |

AML Training | £250.00 | Included |

ICO | £40.00 | Included |

AML, CDD, Record Keeping & Staff Training (policies) | £250.00 | Included |

CDD Forms | £150.00 | Included |

Internal Complaints Procedure | £150.00 | Included |

Risk Assessment Policy and Procedures | £200.00 | Included |

GDPR Policy | £50.00 | Included |

Business Tools Required | ||

| Head of Terms & Option Agreement | £250.00 | Included |

| NDA & Confidentiality Agreement | £200.00 | Included |

BMV Calculator | £40.00 | Included |

HMO Calculator | £80.00 | Included |

BRRR Calculator | £90.00 | Included |

BTL Calculator | £50.00 | Included |

| Sell deals through our partner, Sitefindr® | £97.00 | 1 month Included |

| Additional Items | ||

PI Insurance for Deal Sourcers | £350.00 | £175.00 |

| Client Account (if required) | £50.00 | Access** |

| Total Cost | DIY COST & VALUE | Become Compliant™ |

| £1,997 |

Total Cost to Become Compliant including all bonuses:

only £1,997

you can pay in 3 with Klarna (0% interest)

(£1,997 + £175 Insurance)

Read FAQ to understand why insurance payment is separate.

Already have a subscription? Log in here.

You will pay insurance seperatly, straight after you complete your Intake Form.

The fee is split as £1,997 + £175 = £2,172.

* If you are going to handle client money, you must have a client account and pass the fit and proper test for HMRC. This is an additional £150.00 per person. Client money includes deposits or any refundable monies.

** Use of our client account is chargeable, on a per case basis. We must conduct AML checks on both parties when monies are passed into our account. We take each request on a case by case basis.